Once the work is completed, we conduct a final review to ensure everything aligns with your expectations. We walk you through the final results, answer any questions, and provide you with all the necessary documents or instructions. This is your chance to make any final adjustments before we complete the project. provide me this one small titles

Secure Your Wealth, Protect Your Family, and Plan for a Tax-Efficient Future

Introduction to Inheritance Tax & Estate Planning

Inheritance Tax and Estate Planning are crucial to securing your financial legacy and ensuring your wealth is passed on efficiently. At Azure Wealth, we specialise in minimising inheritance tax liabilities, protecting your assets, and creating a plan that reflects your wishes. Our expert advisers work closely with you to develop tailored strategies that ensure smooth estate management, provide for your loved ones, and preserve your legacy for future generations.

Importance and Benefits

- Minimise Tax Liabilities: Estate planning helps reduce inheritance tax and other tax burdens, ensuring more of your estate goes to your beneficiaries rather than to taxes.

- Protect Your Wealth: By using trusts and other strategies, you can safeguard your assets from creditors, divorce, or other risks, keeping your wealth intact for future generations.

- Ensure Your Wishes Are Followed: A well-structured estate plan ensures your wishes are honoured, dictating how your estate is distributed, who will care for your children, and how your legacy will be managed.

- Provide Financial Security for Loved Ones: Estate planning gives your loved ones peace of mind, knowing your assets are protected and they won’t face the complexities of managing an unclear estate.

Importance and Benefits

Minimise Tax Liabilities

Effective estate planning allows you to reduce inheritance tax and other potential tax burdens, ensuring that your beneficiaries receive a larger portion of your estate rather than it being lost to taxation.Protect Your Wealth

By transferring assets to trusts or using other strategies, you can safeguard your assets from creditors, divorce settlements, or other financial threats, ensuring that your wealth remains intact for future generations.Ensure Your Wishes Are Followed

A clear estate plan ensures that your wishes are respected, allowing you to dictate how your estate is distributed, who will look after your children, and how your legacy will be handled.Provide Financial Security for Loved Ones

Estate planning provides your loved ones with financial peace of mind, knowing that your assets are protected and they won’t be burdened with managing an unclear or complicated estate.

Key Features

Tailored Tax-Efficient Strategies

We offer personalised strategies to help you minimise inheritance tax and ensure your estate is managed in a way that aligns with your financial goals, reducing the impact of taxes on your beneficiaries.

Asset Protection and Wealth Transfer

Our experts assist in transferring assets to trusts or other structures, protecting your wealth from potential risks such as creditors or legal challenges, and ensuring it is efficiently passed on to your heirs.

Estate Review and Legacy Planning

We carefully review your estate plan, ensuring your beneficiary designations are current, and offer guidance on creating a legacy plan that preserves your values and wealth for future generations.

Initial Consultation

We begin by understanding your needs and goals through a detailed consultation. During this step, we listen to your requirements, ask key questions, and offer expert advice to ensure we’re aligned on what you want to achieve. This step helps us create a personalized plan tailored just for you.

Initial Consultation

We begin by understanding your needs and goals through a detailed consultation. During this step, we listen to your requirements, ask key questions, and offer expert advice to ensure we’re aligned on what you want to achieve. This step helps us create a personalized plan tailored just for you.

Customized Plan Creation

After gathering all the information during the consultation, our team works on crafting a customized plan that fits your specific needs. This may include a timeline, pricing structure, and detailed milestones for the entire process. We ensure that all aspects are clearly defined and agreed upon.

Approval and Agreement

Once the plan is ready, we present it to you for approval. You’ll have the opportunity to ask questions, make adjustments, and ensure everything meets your expectations. Once you’re satisfied, we finalize the agreement and get started. We ensure transparency every step of the way.

Approval and Agreement

Once the plan is ready, we present it to you for approval. You’ll have the opportunity to ask questions, make adjustments, and ensure everything meets your expectations. Once you’re satisfied, we finalize the agreement and get started. We ensure transparency every step of the way.

Execution and Delivery

With the plan in place and everything agreed upon, we begin the execution of the project. Whether it’s a product, service, or solution, our team works diligently to ensure everything is done on time and to the highest standard. During this phase, we keep you updated with regular progress reports.

Final Review

Final Review

Once the work is completed, we conduct a final review to ensure everything aligns with your expectations. We walk you through the final results, answer any questions, and provide you with all the necessary documents or instructions. This is your chance to make any final adjustments before we complete the project. provide me this one small titles

How It Works

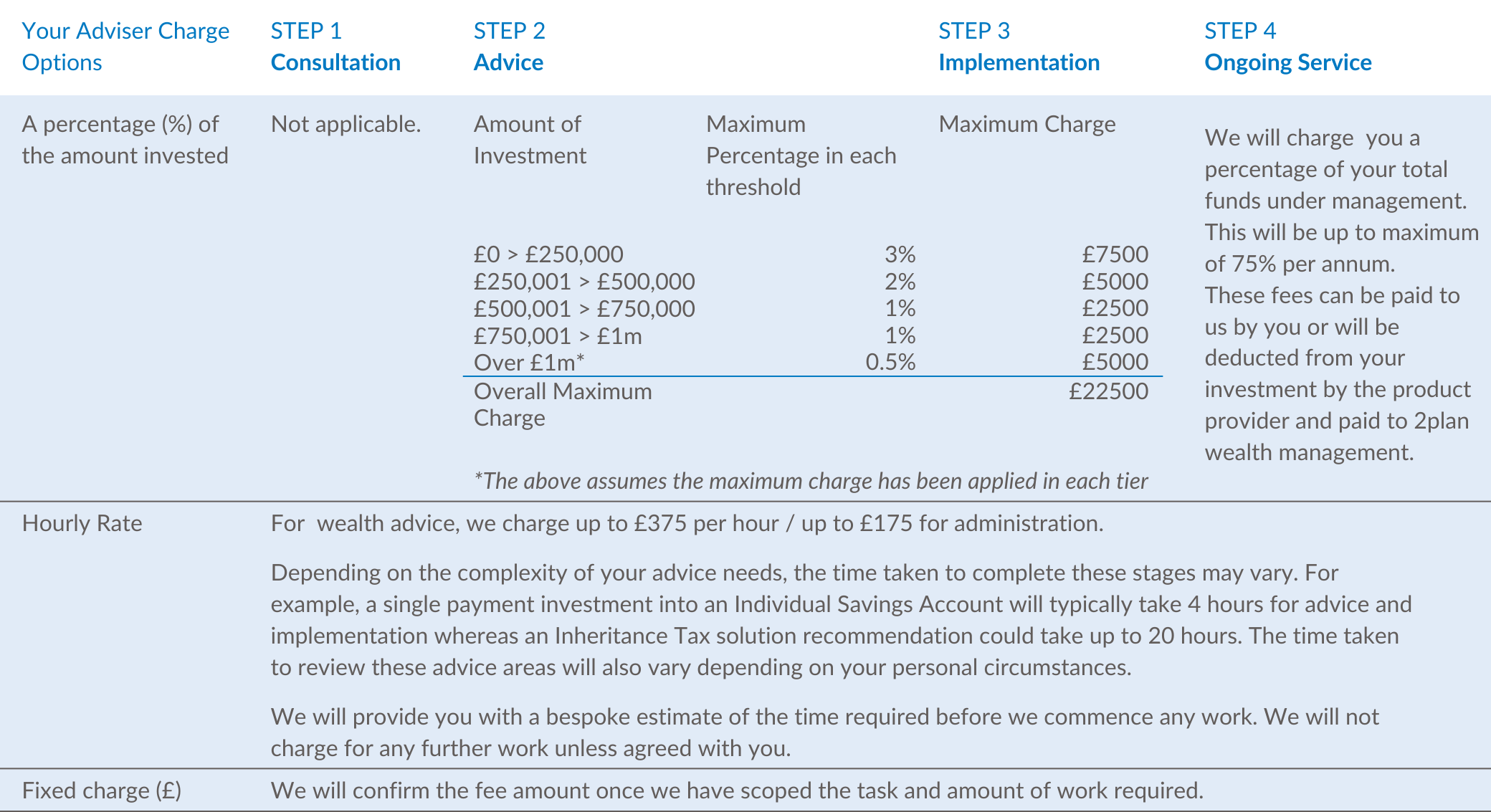

STEP 1

Consultation

- Introduction

- Agree remuneration method

- Information gathering

- Identify goals and objectives

- Create a financial plan

STEP 2

Advice

- Assess objectives

- Review existing plans

- Research

- Devise investment strategy

- Select product(s)

- Recommendation

- Suitability Report

STEP 3

Implementation

- Apply to product provider

- Complete documentation

- Process applications

- Policy documentation

STEP 4

Ongoing Service

- Assess continued suitability of advice

- Complete new investment risk

questionnaire - Provide review report

- Ongoing access to your adviser

What Our Client Says

"Karen and I were introduced to Ravi by the Accountant who looks after my business finances. Between us we had a number of accounts, policies and pension plans and felt like we needed someone to review everything in order to make best use of our finances and to achieve our plans for retirement. Ravi is very approachable and has an excellent knowledge of financial products. He has helped us to make sense of a very complicated subject. Ravi collated all the necessary information and presented a clear recommendation for us to review and approve then, through our annual review meetings, we now feel we are able to keep on track of progress and have much more control and confidence in our financial arrangements. I would not hesitate to recommend Ravi to anyone who is making plans for retirement or who just needs pointing in the right direction to realise their goals. 10/10!"

Andrew & Karen M.

"A friend recommended me to Ravi and I was delighted that she did. Ravi made me more money than my previous financial adviser did, and always had time for me, responding to my questions and calls promptly. I would certainly recommend him."

Sahera C.

"Ravi has been the financial advisor for both me and my wife for more than a year now and we are very happy with what he has done. Not only has Ravi managed to allocate our funds to good schemes which he researched extensively after listening to what we had in mind for the future and what we wished to achieve with our finances. He also discussed with us investment opportunities that would suit my earnings and Shre's earnings respectively as they are vastly different - creating a plan of action that would be tax efficient and well suited to our plans and goals. He has always communicated the status of our investments and is always available to discuss. We feel very taken care of and recommend him and his services for sure."

Sanchit & Shrestha M.

"I was considering taking out a pension fund through my company. I met Ravi who explained the process and also helped pick the best fund that suited my needs. Ravi was both knowledgeable and informative; providing me with detailed comparisons with competitors and showing me how his funds have favourably performed over the long term. Ravi is a consummate professional and I would have no hesitation recommending him. 10/10"

Mark S.

Client Feedback and Reviews

Emma Harrison

⭐⭐⭐⭐⭐(5/5)

I've been using this investment service for six months, and it’s been a fantastic experience so far! The advisors are patient and knowledgeable, answering all my questions thoroughly. I like how they customize the portfolio to match my goals and comfort with risk. My investments have shown steady growth, and I feel confident about my financial future.

Julia Reynolds

⭐⭐⭐⭐⭐ (5/5)

I've been investing for over a year now, and I’m truly impressed with the results! As someone who’s fairly new to investing, I was initially a bit anxious, but the support and guidance I received have been amazing.

Lucas Brown

⭐⭐⭐⭐⭐ (5/5)

After switching to this investment service, I’ve seen my portfolio grow at a rate I didn’t think was possible. Their advisors are fantastic at explaining strategies, which has really helped me feel informed and empowered about where my money is going. Plus, the fee structure is very transparent, with no hidden charges, which I really appreciate.

FAQ

What is Inheritance Tax and how is it calculated?

Inheritance tax is a tax on the estate (property, money, and possessions) of someone who has passed away. The tax is calculated based on the value of the estate above a certain threshold. Our team can help you understand your tax liability and develop strategies to reduce it through effective estate planning.

How can estate planning help reduce my inheritance tax liabilities?

Estate planning allows you to make informed decisions about the distribution of your estate, use tax-efficient strategies like trusts, and make gifts during your lifetime to reduce the taxable value of your estate, potentially lowering your inheritance tax bill.

What is a Trust, and how does it work in estate planning?

A trust is a legal arrangement where a third party, known as a trustee, holds and manages assets on behalf of beneficiaries. Trusts are commonly used in estate planning to protect assets, minimise inheritance tax, and ensure that your wealth is distributed according to your wishes.

Do I need to update my estate plan regularly?

Yes, it is important to review and update your estate plan regularly to reflect any changes in your personal circumstances, such as marriage, children, or changes in the value of your assets. We help you keep your plan up-to-date to ensure it remains effective.

How can estate planning help reduce inheritance tax?

Estate planning allows you to use tools such as trusts, gifting, and charitable donations to lower the taxable value of your estate. We provide strategies to minimise tax liabilities while ensuring your wishes are fulfilled.

How do I start planning my estate with Azure Wealth?

Getting started is easy! Simply schedule a consultation with one of our expert advisers. We will assess your current estate plan, identify areas for improvement, and guide you through the necessary steps to create a comprehensive plan that suits your needs and goals.