Once the work is completed, we conduct a final review to ensure everything aligns with your expectations. We walk you through the final results, answer any questions, and provide you with all the necessary documents or instructions. This is your chance to make any final adjustments before we complete the project. provide me this one small titles

Empowering Your Financial Journey with Unbiased Expertise and Tailored Solutions.

Introduction to Our Services

At Azure Wealth, we provide a comprehensive range of independent financial advisory services to help you achieve long-term security and success. Our team works closely with you to develop personalised strategies that align with your goals, whether it’s wealth planning, retirement, or inheritance tax solutions.

Importance and Benefits

- Impartial Guidance: Get unbiased advice focused entirely on your best interests.

- Comprehensive Solutions: Access a full range of financial services, from wealth management to tax planning, all under one roof.

- Tailored Strategies: Enjoy personalised plans designed to fit your unique financial situation, goals, and risk tolerance.

- Expertise & Experience: Collaborate with a team of seasoned professionals committed to helping you make informed decisions for long-term success.

- Peace of Mind: Rest easy knowing your financial future is in the hands of trusted experts who prioritise your needs.

Importance and Benefits

- Impartial Guidance: Receive advice that is unbiased and solely focused on your best interests.

- Comprehensive Solutions: Access a wide range of financial products and services, from wealth management to tax planning, all in one place.

- Tailored Strategies: Every plan is personalized to fit your unique financial situation, goals, and risk tolerance.

- Expertise & Experience: Work with a team of seasoned professionals dedicated to helping you make informed decisions for long-term success.

- Peace of Mind: Feel confident knowing your financial future is in the hands of trusted experts who put your needs first.

Key Features

Comprehensive Market Access

As independent advisers, we give you access to a broad range of financial products from multiple providers. This ensures you always get the best options tailored to your needs.

Personalised Financial Strategies

We work closely with you to understand your financial goals and create strategies designed to help you achieve long-term success and security in your financial journey.

Impartial, Unbiased

Advice

Our independence lets us provide advice free from product or provider influence. We prioritize your best interests above all. This ensures objective .

Initial Consultation

We begin by understanding your needs and goals through a detailed consultation. During this step, we listen to your requirements, ask key questions, and offer expert advice to ensure we’re aligned on what you want to achieve. This step helps us create a personalized plan tailored just for you.

Initial Consultation

We begin by understanding your needs and goals through a detailed consultation. During this step, we listen to your requirements, ask key questions, and offer expert advice to ensure we’re aligned on what you want to achieve. This step helps us create a personalized plan tailored just for you.

Customized Plan Creation

After gathering all the information during the consultation, our team works on crafting a customized plan that fits your specific needs. This may include a timeline, pricing structure, and detailed milestones for the entire process. We ensure that all aspects are clearly defined and agreed upon.

Approval and Agreement

Once the plan is ready, we present it to you for approval. You’ll have the opportunity to ask questions, make adjustments, and ensure everything meets your expectations. Once you’re satisfied, we finalize the agreement and get started. We ensure transparency every step of the way.

Approval and Agreement

Once the plan is ready, we present it to you for approval. You’ll have the opportunity to ask questions, make adjustments, and ensure everything meets your expectations. Once you’re satisfied, we finalize the agreement and get started. We ensure transparency every step of the way.

Execution and Delivery

With the plan in place and everything agreed upon, we begin the execution of the project. Whether it’s a product, service, or solution, our team works diligently to ensure everything is done on time and to the highest standard. During this phase, we keep you updated with regular progress reports.

Final Review

Final Review

Once the work is completed, we conduct a final review to ensure everything aligns with your expectations. We walk you through the final results, answer any questions, and provide you with all the necessary documents or instructions. This is your chance to make any final adjustments before we complete the project. provide me this one small titles

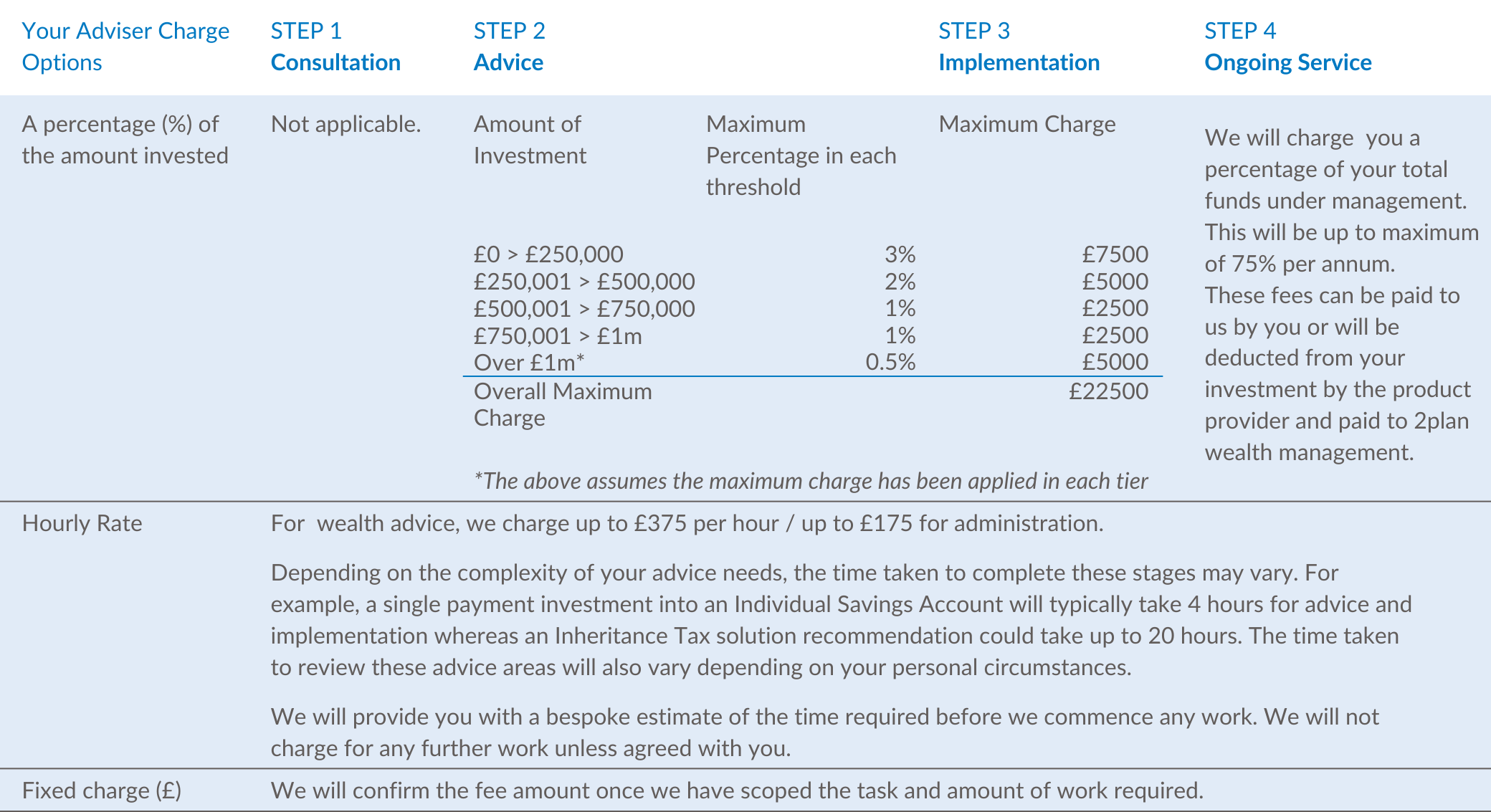

How It Works

STEP 1

Consultation

- Introduction

- Agree remuneration method

- Information gathering

- Identify goals and objectives

- Create a financial plan

STEP 2

Advice

- Assess objectives

- Review existing plans

- Research

- Devise investment strategy

- Select product(s)

- Recommendation

- Suitability Report

STEP 3

Implementation

- Apply to product provider

- Complete documentation

- Process applications

- Policy documentation

STEP 4

Ongoing Service

- Assess continued suitability of advice

- Complete new investment risk questionnaire

- Provide review report

- Ongoing access to your adviser

Fees

Note: The exact fees will be determined by the end of the meeting

What Our Client Says

"Karen and I were introduced to Ravi by the Accountant who looks after my business finances. Between us we had a number of accounts, policies and pension plans and felt like we needed someone to review everything in order to make best use of our finances and to achieve our plans for retirement. Ravi is very approachable and has an excellent knowledge of financial products. He has helped us to make sense of a very complicated subject. Ravi collated all the necessary information and presented a clear recommendation for us to review and approve then, through our annual review meetings, we now feel we are able to keep on track of progress and have much more control and confidence in our financial arrangements. I would not hesitate to recommend Ravi to anyone who is making plans for retirement or who just needs pointing in the right direction to realise their goals. 10/10!"

Andrew & Karen M.

"A friend recommended me to Ravi and I was delighted that she did. Ravi made me more money than my previous financial adviser did, and always had time for me, responding to my questions and calls promptly. I would certainly recommend him."

Sahera C.

"Ravi has been the financial advisor for both me and my wife for more than a year now and we are very happy with what he has done. Not only has Ravi managed to allocate our funds to good schemes which he researched extensively after listening to what we had in mind for the future and what we wished to achieve with our finances. He also discussed with us investment opportunities that would suit my earnings and Shre's earnings respectively as they are vastly different - creating a plan of action that would be tax efficient and well suited to our plans and goals. He has always communicated the status of our investments and is always available to discuss. We feel very taken care of and recommend him and his services for sure."

Sanchit & Shrestha M.

"I was considering taking out a pension fund through my company. I met Ravi who explained the process and also helped pick the best fund that suited my needs. Ravi was both knowledgeable and informative; providing me with detailed comparisons with competitors and showing me how his funds have favourably performed over the long term. Ravi is a consummate professional and I would have no hesitation recommending him. 10/10"

Mark S.

Client Feedback and Reviews

Emma Chang

⭐⭐⭐⭐⭐

After switching to this investment service, I’ve seen my portfolio grow at a rate I didn’t think was possible. Their advisors are fantastic at explaining strategies, which has really helped me feel informed and empowered about where my money is going. Plus, the fee structure is very transparent, with no hidden charges, which I really appreciate.

Julia Reynolds

⭐⭐⭐⭐⭐

I've been investing for over a year now, and I’m truly impressed with the results! As someone who’s fairly new to investing, I was initially a bit anxious, but the support and guidance I received have been amazing.

Lucas Brown

⭐⭐⭐⭐

I've been using this investment service for six months, and it’s been a fantastic experience so far! The advisors are patient and knowledgeable, answering all my questions thoroughly. I like how they customize the portfolio to match my goals and comfort with risk. My investments have shown steady growth, and I feel confident about my financial future.

FAQ

What is an Independent Financial Adviser (IFA)?

An Independent Financial Adviser (IFA) is a professional who provides unbiased financial advice on a wide range of products and services available in the market. Unlike restricted advisers, IFAs are not tied to specific companies or products, ensuring you receive impartial advice tailored to your unique financial needs.

How is an IFA different from a restricted adviser?

While restricted advisers are limited to recommending products from certain providers, IFAs have access to the entire market, allowing them to offer a broader range of solutions and more tailored advice.

What services can an IFA provide?

IFAs can assist with various financial services, including wealth planning, investment management, retirement planning, inheritance tax planning, and much more. Their goal is to create a comprehensive strategy to help you achieve your financial objectives.

How does an IFA ensure impartiality?

Independent Financial Advisers are required to conduct extensive market research and adhere to strict regulatory standards. This ensures they provide advice based on your best interests rather than being influenced by affiliations with financial product providers.

How do I choose the right IFA for my needs?

When selecting an IFA, look for qualifications, experience, and client reviews. It’s also essential to ensure the adviser is FCA-regulated and transparent about their fees. At Azure Wealth, we pride ourselves on our expertise, professionalism, and commitment to helping clients achieve financial freedom.

Do I need an IFA if I already have a financial plan?

Yes, even if you have a financial plan, an IFA can offer valuable insights and help you identify areas for improvement. They can review your current plan to ensure it aligns with your long-term goals and is optimised for market conditions.